Nina Uzunovic is winner of the Smith Family Scholarship in Economic Policy. The scholarship is one of 25 prizes awarded at the Undergraduate Awards of Academic Excellence that were presented by the Department of Economics on 6 March, 2024 for the 2022-2023 academic year.

Endowed by James C. Smith, the scholarship is awarded to an outstanding student in Economics who intends to focus on economic policy or economic history, In addition to a strong academic performance, this unique award is also based on student writing. Applicants must write a short essay analyzing a current economic policy issue.

In the winning essay published below, Uzunovic, a third year student majoring in Economics and Public Policy examined the consequences of using quantitative easing (QE) as a form of pandemic relief that are currently being felt in the US.

Easy Liquidity & The Problem of QE Withdrawal

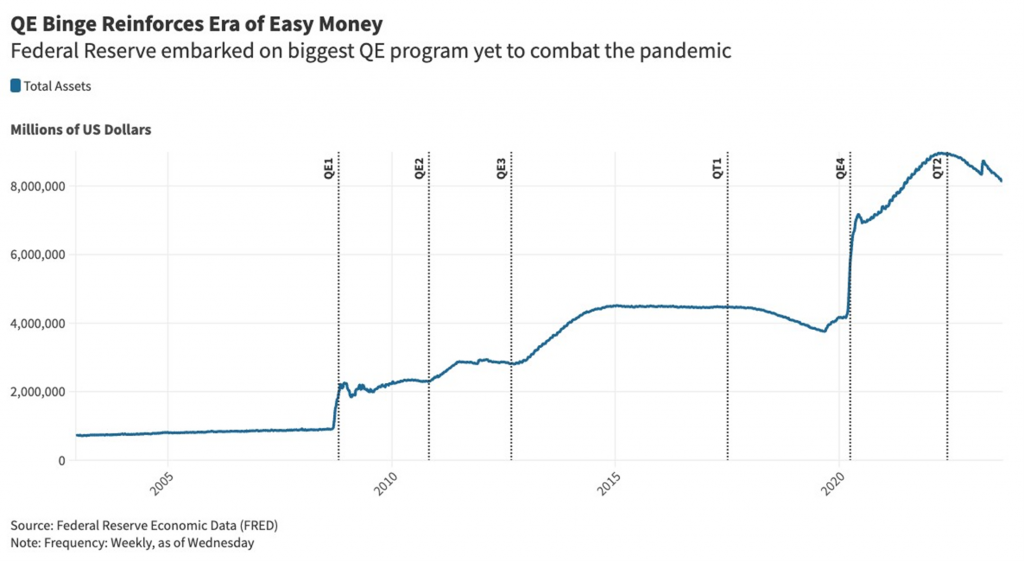

Officials from the St. Louis Federal Reserve are ringing the alarm that the consequences of using quantitative easing (QE) – a large-scale asset purchasing policy – to combat the pandemic are starting to be felt in the US.1 They warn that the current quantitative tightening (QT) efforts, the reverse of QE, may need to be paused to avoid causing “undo financial stress.” Although a favoured policy, this is not the first time that QT is risking financial stability, the same occurred in 2017 and at the onset of the pandemic.2 Like an addiction, QE hooks the financial sector into a cycle of easy money, making it vulnerable to instability when it is forced into withdrawal through QT. With studies demonstrating limited benefits of QE while the risks remain dangerous, it is time for the policy to be retired.3

Seeking to counter low demand, central banks engage in conventional monetary policy by lowering their policy rates to create attractive lending conditions. However, when policy rates are near zero, they instead turn to unconventional tools such as QE.4 This was the case during the pandemic, making it the go-to policy for the UK, Canada, the European Union, and the US – who initially debuted the tool as an emergency measure during the 2008 financial crisis.

QE consists of large-scale open market asset purchases of government bonds and securities through commercial bank reserves – deposits that banks hold at the central bank.6 By buying large quantities of bonds and injecting a massive amount of liquidity into the financial sector, the price of bonds gets pushed up and subsequently lowers their yield. This decrease compresses long-term borrowing rates, fostering attractive lending conditions and stimulating economic activity through investment.

Then, when an economy is overheating, central banks embark on QT. No longer purchasing assets, central banks wait until the assets mature – shrinking their balance sheets over time – or they actively sell off the assets to speed up the process.7 Regardless, the aim is for the easy lending induced by QE to significantly fall.

However, when the Fed first embarked on QT in 2017, the tool was met with liquidity stress in 2019, forcing them to resume purchases.8 A similar episode occurred at the onset of the pandemic, by which point QE was already instituted again; commercial banks faced tighter access to liquidity while simultaneously having many credit lines called on. Although QE did provide much needed liquidity to markets in 2020, it is questionable whether that initial need for liquidity would have still occurred had the Fed not previously engaged in QT.9 But the problem is not QT itself. Rather, commercial banks have an asymmetric response to a shrinkage in reserves – the decline is not met with a commensurate decrease in claims on liquidity.

Until this adverse bank behaviour is understood, and policy is adapted, QE only brings problems, making it ill-advised for future usage. Moral hazard is a likely culprit, where banks are incentivized to ignore tightening conditions – to maintain commercial relationships for instance – and instead continue issuing liquidity claims, but it still doesn’t explain everything.14 It is also important to note that any initial benefits from QE to economic output and inflation are also relatively small, with a recent analysis deeming that the Fed’s pandemic QE was rather inconsequential to the economy.15

The lessons from the US are especially of importance to a country like Canada which is in its first ever dalliance with QT, having debuted QE during the pandemic.16 With the current fight against high inflation, the conflicting objectives of financial stability and stable, low prices, make it difficult to immediately abandon QT and high policy rates. To avoid a repeat of the US, Canadian officials must monitor the stress levels of banks to ensure that inter-bank liquidity remains without barriers – and retire QE from its policy arsenal.

End Notes

- Alex Harris, T-Bill Deluge Risks Draining Bank Reserves, St. Louis Fed Warns, (Bloomberg News, 2023).

- Sascha Steffen et al., Liquidity Dependence and the Waxing and Waning of Central Bank Balance Sheets, (Cambridge: MA, 2023).

- Brian Fabo et al., “Fifty Shades of QE: Comparing Findings of Central Bankers and Academics,” Journal of Monetary Economics 120 (2021): 1–20, https://doi.org/10.1016/j.jmoneco.2021.04.001; Lu, Brian L, William R Nelson, and Andrew T Levin. Quantifying the Costs and Benefits of Quantitative Easing. NBER Working Paper Series, 2022. https://doi.org/10.3386/w30749.

- Bank of Canada, Understanding quantitative easing, (Bank of Canada, 2022).

- Allison Schrager, It’s Now Clear That QE Was a Colossal Policy Mistake, (Bloomberg News, 2022).

- Bank of Canada, 2022.

- Bank of Canada, 2022.

- Steffen et al., 2023, 1.

- Steffen et al., 2023, 4.

- Viral V Acharya and Raghuram Rajan, Quantitative Easing Left the Banking System Vulnerable, (Barron’s, 2023).

- Steffen et al., 2023, 2.

- Viral V Acharya and Raghuram Rajan, 2023.

- Steffen et al., 2023, 5.

- Steffen et al., 2023, 35.

- Lu, Brian L, William R Nelson, and Andrew T Levin, 2022, 39.

- Bank of Canada, 2022; Erik Hertzberg and Esteban Duarte, Bank of Canada starts quantitative easingwith $1 billion bond purchase, (BNN Bloomberg, 2020).

- Steffen et al., 2023, 36.

Bibliography

Bank of Canada. “Understanding quantitative easing.” Bank of Canada, 2022. https://www.bankofcanada.ca/2022/06/understanding–quantitative–easing.

Fabo, Brian, Martina Jančoková, Elisabeth Kempf, and Ľuboš Pástor. “Fifty Shades of QE: Comparing Findings of Central Bankers and Academics.” Journal of Monetary Economics 120 (2021): 1–20. https://doi.org/10.1016/j.jmoneco.2021.04.001.

Harris, Alex. “T-Bill Deluge Risks Draining Bank Reserves, St. Louis Fed Warns.” Bloomberg News, 2023. https://www.bloomberg.com/news/articles/2023–08–24/t–bill–deluge–risksdraining–bank–reserves–st–louis–fed–warns.

Hertzberg, Erik, and Esteban Duarte. “Bank of Canada starts quantitative easing with $1 billion bond purchase.” BNN Bloomberg, 2020. https://www.bnnbloomberg.ca/bank–of–canadastarts–quantitative–easing–with–1–billion–bond–purchase–1.1416019#:~:text=The%20Bank%20of%20Canada%20began,%241.0%20billion%20in %20government%20bonds.

Lu, Brian L, William R Nelson, and Andrew T Levin. “Quantifying the Costs and Benefits of Quantitative Easing.” NBER Working Paper Series, 2022. https://doi.org/10.3386/w30749.

Rajan, Raghuram, and Viral V Acharya. “Liquidity, Liquidity Everywhere, Not a Drop to Use – Why Flooding Banks with Central Bank Reserves May Not Expand Liquidity.” NBER Working Paper Series, 2022. https://doi.org/10.3386/w29680.

Rajan, Raghuram, and Viral V Acharya. “Quantitative Easing Left the Banking System Vulnerable.” Barron’s, 2023. https://www.barrons.com/articles/sbv–fed–qe–banking–crisis–22175ec0.

Schrager, Allison. “It’s Now Clear That QE Was a Colossal Policy Mistake.” Bloomberg News, 2022. https://www.bloomberg.com/opinion/articles/2022–11–22/fed–s–qe–was–a–colossalmonetary–policy–mistake.

Steffen, Sascha, Viral V Acharya, Rahul S Chauhan, and Raghuram Rajan. “Liquidity Dependence and the Waxing and Waning of Central Bank Balance Sheets.” NBER Working Paper Series, 2023. https://doi.org/10.3386/w31050.

Return to the Department of Economics website.

Scroll more news.